How are your tax dollars spent?

Although this interactive calculator was released by the White House in April of this year, I had not seen it until recently. With all of the current politicking and campaigning, it was nice to see something that allowed me to drill down into some details of tax spending– normally presented in a pretty dry and boring way — with this tool that is easy to understand.

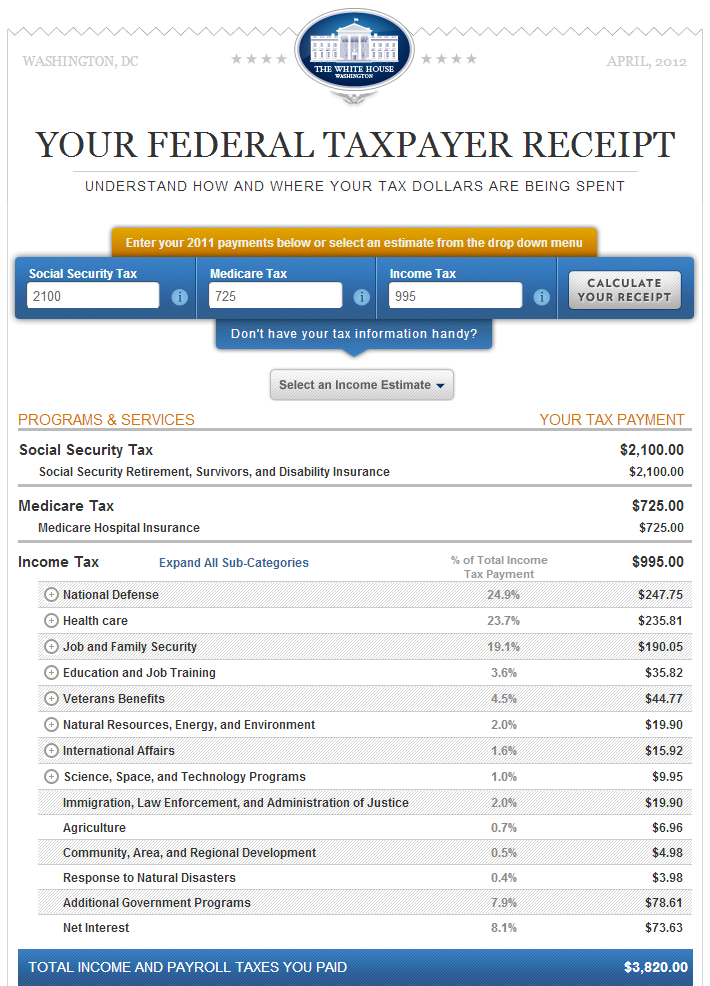

You can either enter your own 2011 tax payments for Social Security, Medicare, and income tax, or choose an income estimate. The income estimates include various income scenarios and family compositions–from $25,000 income for a single individual with no children to an $80,000 income for a family that was married with two children–and clearly specify the assumptions made about deductions and tax credits. The scenarios enable you to see how the proportion of taxes paid shifts according to total income and family structure, and the receipt provides a detailed breakdown of the disbursement of federal income taxes.

Under the income taxes, the receipt allocates the federal income taxes paid to a wide variety of federal programs. It is very easy to identify spending on certain social welfare programs, such as unemployment insurance, Social Security, and tax credits like the Earned Income and Child Tax credits. Due to their very nature however, it is difficult, if not impossible, to account for other key social welfare programs such as tax deductions for mortgage interest (whether this is captured in the “Mortgage Credit” under “Additional Government Programs” is unclear).

While it is not shocking to anyone that reads the news that Social Security and Medicare dominate spending, a few things took me by surprise:

- When you add together spending on national defense (24.9%) as well as veteran’s benefits (4.5%), we spend nearly thirty percent of revenue from income taxes directly on defense-related expenses.

- In contrast, government-supported student financial aid for college makes up 0.04% of income tax spending, funding for the National Science Foundation and other related research is 0.4%, and total spending on natural resources, energy, and the environment is 2%.

Of course, small percentages of large revenue streams can still generate big expenditures…but it also helps to put into perspective the consequences of the deficit: 8.1% of income tax revenues go toward paying interest. This is 200 times more than the spending on student loans, 20 times more than the spending on scientific research, and 4 times all of the money spent on natural resources, energy, and the environment.

While not everyone agrees on how the budget should be allocated, knowledge about its current allocation pattern is critical to inform people about where changes could be made in the future and why some changes may be necessary.